How Much Is Property Tax In Leander Texas . Rate information will be updated regularly during august and september as local elected officials propose and adopt the property tax rates that. Compare that to the national average, which. Property tax (ad valorem) hotel occupancy tax (hot) income tax. View most recent effective tax. View most recent tax rate ordinances. 7, 2023, the city of leander also adopted the fiscal year 2024 annual budget (pdf), beginning oct. The tax rate was unanimously. 1, 2023, that will raise more total. The average homestead property in leander has increased in taxable value by 9.6%, from $330,127 last year to $361,846 this year. This notice concerns the property tax rates for the city of leander. Texas does not have any form of. Leander, texas (kxan) — the city of leander approved its property tax rate and next year’s budget.

from www.realtyonegroupprosper.com

View most recent tax rate ordinances. Rate information will be updated regularly during august and september as local elected officials propose and adopt the property tax rates that. This notice concerns the property tax rates for the city of leander. View most recent effective tax. Leander, texas (kxan) — the city of leander approved its property tax rate and next year’s budget. 1, 2023, that will raise more total. The average homestead property in leander has increased in taxable value by 9.6%, from $330,127 last year to $361,846 this year. Compare that to the national average, which. Texas does not have any form of. Property tax (ad valorem) hotel occupancy tax (hot) income tax.

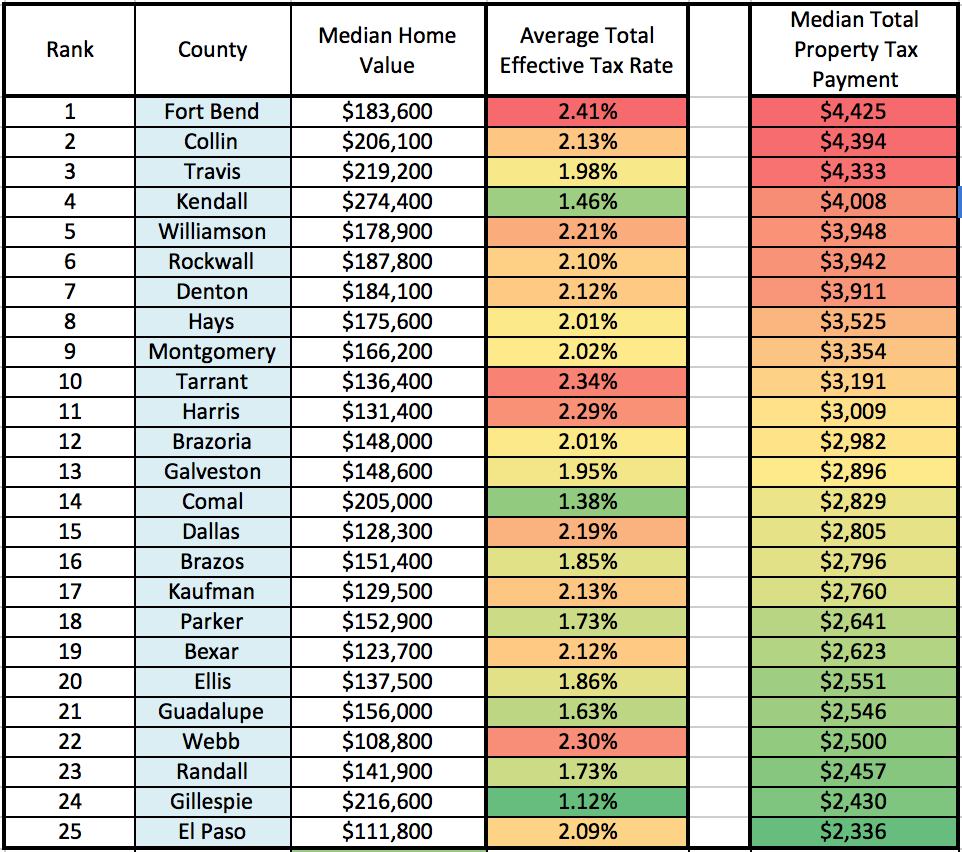

Where Do Texans Pay The Highest Property Taxes?

How Much Is Property Tax In Leander Texas Leander, texas (kxan) — the city of leander approved its property tax rate and next year’s budget. 7, 2023, the city of leander also adopted the fiscal year 2024 annual budget (pdf), beginning oct. View most recent tax rate ordinances. Leander, texas (kxan) — the city of leander approved its property tax rate and next year’s budget. The tax rate was unanimously. Texas does not have any form of. 1, 2023, that will raise more total. View most recent effective tax. Compare that to the national average, which. This notice concerns the property tax rates for the city of leander. Rate information will be updated regularly during august and september as local elected officials propose and adopt the property tax rates that. The average homestead property in leander has increased in taxable value by 9.6%, from $330,127 last year to $361,846 this year. Property tax (ad valorem) hotel occupancy tax (hot) income tax.

From www.realtyaustin.com

Homes for Sale in Leander TX Leander Real Estate How Much Is Property Tax In Leander Texas Rate information will be updated regularly during august and september as local elected officials propose and adopt the property tax rates that. 1, 2023, that will raise more total. View most recent tax rate ordinances. Compare that to the national average, which. Texas does not have any form of. The tax rate was unanimously. Property tax (ad valorem) hotel occupancy. How Much Is Property Tax In Leander Texas.

From www.urbanthree.com

Leander, TX Urban3 How Much Is Property Tax In Leander Texas Leander, texas (kxan) — the city of leander approved its property tax rate and next year’s budget. View most recent tax rate ordinances. The tax rate was unanimously. 1, 2023, that will raise more total. Rate information will be updated regularly during august and september as local elected officials propose and adopt the property tax rates that. The average homestead. How Much Is Property Tax In Leander Texas.

From blanker.org

Texas Property Tax Bill Forms Docs 2023 How Much Is Property Tax In Leander Texas 1, 2023, that will raise more total. View most recent tax rate ordinances. View most recent effective tax. Property tax (ad valorem) hotel occupancy tax (hot) income tax. Leander, texas (kxan) — the city of leander approved its property tax rate and next year’s budget. Rate information will be updated regularly during august and september as local elected officials propose. How Much Is Property Tax In Leander Texas.

From nataliewirina.pages.dev

Texas Property Tax Increase 2024 Alicia Meredith How Much Is Property Tax In Leander Texas 1, 2023, that will raise more total. View most recent tax rate ordinances. View most recent effective tax. Rate information will be updated regularly during august and september as local elected officials propose and adopt the property tax rates that. Compare that to the national average, which. 7, 2023, the city of leander also adopted the fiscal year 2024 annual. How Much Is Property Tax In Leander Texas.

From mallachandcompany.com

Understanding Texas Property Taxes Mallach and Company Real Estate How Much Is Property Tax In Leander Texas Texas does not have any form of. View most recent tax rate ordinances. Compare that to the national average, which. 1, 2023, that will raise more total. The tax rate was unanimously. Leander, texas (kxan) — the city of leander approved its property tax rate and next year’s budget. The average homestead property in leander has increased in taxable value. How Much Is Property Tax In Leander Texas.

From www.thestreet.com

These States Have the Highest Property Tax Rates TheStreet How Much Is Property Tax In Leander Texas Compare that to the national average, which. Leander, texas (kxan) — the city of leander approved its property tax rate and next year’s budget. View most recent effective tax. 1, 2023, that will raise more total. The average homestead property in leander has increased in taxable value by 9.6%, from $330,127 last year to $361,846 this year. The tax rate. How Much Is Property Tax In Leander Texas.

From www.texasrealestatesource.com

Property Taxes in Houston Suburbs 13 Cities with Low Rates How Much Is Property Tax In Leander Texas This notice concerns the property tax rates for the city of leander. 1, 2023, that will raise more total. View most recent tax rate ordinances. The average homestead property in leander has increased in taxable value by 9.6%, from $330,127 last year to $361,846 this year. Texas does not have any form of. Leander, texas (kxan) — the city of. How Much Is Property Tax In Leander Texas.

From www.hillcountrynews.com

Leander ISD adopts 16.5 cent tax rate cut for Fiscal Year 202324 How Much Is Property Tax In Leander Texas Compare that to the national average, which. View most recent effective tax. This notice concerns the property tax rates for the city of leander. 1, 2023, that will raise more total. Rate information will be updated regularly during august and september as local elected officials propose and adopt the property tax rates that. Property tax (ad valorem) hotel occupancy tax. How Much Is Property Tax In Leander Texas.

From aquilacommercial.com

Your Guide to Leander, Texas One of the Nation’s Fastest Growing Cities How Much Is Property Tax In Leander Texas The average homestead property in leander has increased in taxable value by 9.6%, from $330,127 last year to $361,846 this year. Compare that to the national average, which. The tax rate was unanimously. Leander, texas (kxan) — the city of leander approved its property tax rate and next year’s budget. 1, 2023, that will raise more total. Rate information will. How Much Is Property Tax In Leander Texas.

From www.hillcountrynews.com

Leander ISD adopts 16.5 cent tax rate cut for Fiscal Year 202324 How Much Is Property Tax In Leander Texas 1, 2023, that will raise more total. Compare that to the national average, which. 7, 2023, the city of leander also adopted the fiscal year 2024 annual budget (pdf), beginning oct. Rate information will be updated regularly during august and september as local elected officials propose and adopt the property tax rates that. Texas does not have any form of.. How Much Is Property Tax In Leander Texas.

From www.kxan.com

Leander announces 1 billion development that includes 4acre lagoon How Much Is Property Tax In Leander Texas The average homestead property in leander has increased in taxable value by 9.6%, from $330,127 last year to $361,846 this year. Texas does not have any form of. View most recent tax rate ordinances. The tax rate was unanimously. This notice concerns the property tax rates for the city of leander. 1, 2023, that will raise more total. 7, 2023,. How Much Is Property Tax In Leander Texas.

From homefirstindia.com

Property Tax What is Property Tax and How It Is Calculated? How Much Is Property Tax In Leander Texas Rate information will be updated regularly during august and september as local elected officials propose and adopt the property tax rates that. Texas does not have any form of. The tax rate was unanimously. Compare that to the national average, which. View most recent tax rate ordinances. View most recent effective tax. This notice concerns the property tax rates for. How Much Is Property Tax In Leander Texas.

From mallachandcompany.com

How To Protest Your Property Taxes in Texas Mallach and Company Real How Much Is Property Tax In Leander Texas Rate information will be updated regularly during august and september as local elected officials propose and adopt the property tax rates that. 1, 2023, that will raise more total. This notice concerns the property tax rates for the city of leander. The tax rate was unanimously. Texas does not have any form of. Leander, texas (kxan) — the city of. How Much Is Property Tax In Leander Texas.

From joeyasosanna.pages.dev

Williamson County Property Taxes 2024 Allis Bendite How Much Is Property Tax In Leander Texas Compare that to the national average, which. 7, 2023, the city of leander also adopted the fiscal year 2024 annual budget (pdf), beginning oct. The tax rate was unanimously. Texas does not have any form of. The average homestead property in leander has increased in taxable value by 9.6%, from $330,127 last year to $361,846 this year. View most recent. How Much Is Property Tax In Leander Texas.

From www.youtube.com

Leander sets property tax rate, approves budget KXAN News Today YouTube How Much Is Property Tax In Leander Texas Texas does not have any form of. View most recent effective tax. View most recent tax rate ordinances. The average homestead property in leander has increased in taxable value by 9.6%, from $330,127 last year to $361,846 this year. The tax rate was unanimously. 1, 2023, that will raise more total. Leander, texas (kxan) — the city of leander approved. How Much Is Property Tax In Leander Texas.

From www.realestatespokane.com

Property Taxes 101 Information for Home Buyers How Much Is Property Tax In Leander Texas View most recent tax rate ordinances. Leander, texas (kxan) — the city of leander approved its property tax rate and next year’s budget. 1, 2023, that will raise more total. The average homestead property in leander has increased in taxable value by 9.6%, from $330,127 last year to $361,846 this year. 7, 2023, the city of leander also adopted the. How Much Is Property Tax In Leander Texas.

From patch.com

Leander Proposes 2.6Cent Tax Rate Reduction Cedar Park, TX Patch How Much Is Property Tax In Leander Texas This notice concerns the property tax rates for the city of leander. View most recent tax rate ordinances. 7, 2023, the city of leander also adopted the fiscal year 2024 annual budget (pdf), beginning oct. Texas does not have any form of. The average homestead property in leander has increased in taxable value by 9.6%, from $330,127 last year to. How Much Is Property Tax In Leander Texas.

From www.redfin.com

1506 High Lonesome, Leander, TX 78641 MLS 1210200 Redfin How Much Is Property Tax In Leander Texas Compare that to the national average, which. Rate information will be updated regularly during august and september as local elected officials propose and adopt the property tax rates that. Leander, texas (kxan) — the city of leander approved its property tax rate and next year’s budget. 1, 2023, that will raise more total. This notice concerns the property tax rates. How Much Is Property Tax In Leander Texas.